Debt Management Hub

Understanding Your Starting Point

August 6, 2025

Creating a Clear Debt Snapshot: What You Owe and to Whom

Create a clear debt snapshot after losing a spouse. Learn to organize debts, understand what you owe, and find out which debts are forgiven at death.

Learn More

August 6, 2025

Demystifying Your Credit Score: What It Is and Why It Matters

Understand your credit score after the death of a spouse. Learn what a credit score is, why it matters, and how to check your credit report for free.

Learn More

August 6, 2025

First Steps After Financial Loss: A Gentle Guide to Your Debts

Grieving a loss? Our gentle guide helps widows take the first steps in managing finances. Learn about your responsibility for a deceased spouse's debt and find clarity.

Learn More

August 6, 2025

Reading the Fine Print: Understanding Your Loan and Credit Card Statements

Learn to read and understand your credit card and loan statements. Our simple guide breaks down the fine print, from APR to minimum payments, to help you take control.

Learn More

Taking Control with a Plan

August 6, 2025

Two Paths to Freedom: The Debt Snowball vs. The Debt Avalanche

Learn the difference between the debt snowball and debt avalanche methods. Discover which debt repayment strategy is right for you to pay off debt faster.

Learn More

August 6, 2025

The 'Aha!' Moment: Building a Budget That Works for You

Learn to build a budget that works for you. Explore simple budgeting methods and compare the best budgeting apps like YNAB, Monarch Money, and Copilot to take control.

Learn More

August 6, 2025

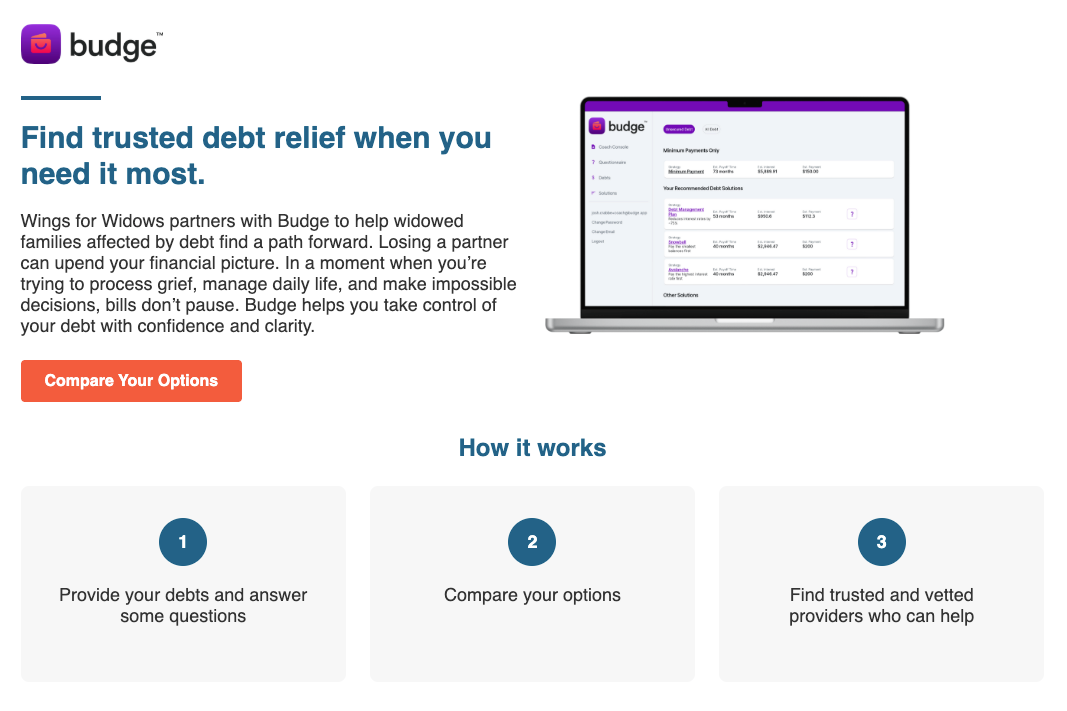

Featured Tool: Meet Budge, Your Partner in Debt Management

Meet Budge, a debt management tool featured by Wings for Widows. Learn how our partner can help you budget, track spending, and create a plan to pay off debt.

Learn More

August 6, 2025

Boosting Your Income: Creative Ways to Accelerate Your Debt Payoff

Discover creative ways to boost your income and pay off debt faster. Learn how to turn hobbies into cash, find flexible side hustles, and accelerate your financial goals.

Learn More

Advanced Strategies & Specific Debts

Protecting Your Future

August 6, 2025

Rebuilding Your Credit After Debt

Learn how to rebuild your credit after paying off debt. Our guide offers simple, effective habits for building a strong credit score and securing your financial future.

Learn More

August 6, 2025

Building an Emergency Fund: Your Financial Safety Net

Learn how to build an emergency fund after a loss. Our guide explains how much to save, where to keep your money, and how to start building your financial safety net.

Learn More

August 6, 2025

Beyond Debt: Setting New Financial Goals for Your Future

What comes after paying off debt? Learn how to set new financial goals, from saving for retirement to investing, and start building a secure and joyful future.

Learn More

August 6, 2025

Avoiding Predatory Lending and Scams

Learn to protect yourself from predatory lending and common financial scams. Our guide shows you the red flags to watch for and how to keep your finances safe.

Learn More

Additional Resources

These organizations provide free, trustworthy information and consumer protection.

Consumer Financial Protection Bureau (CFPB): A U.S. government agency dedicated to making sure you are treated fairly by banks, lenders, and other financial companies. Their website has a massive library of resources on debt, credit, mortgages, and more.

Federal Trade Commission (FTC): The FTC is the nation's primary consumer protection agency. Their site provides essential information on avoiding scams, understanding your credit rights, and dealing with debt collectors.

National Foundation for Credit Counseling (NFCC): A non-profit organization that provides access to accredited, non-profit financial counselors. They can help with creating a budget, managing debt, and developing a formal Debt Management Plan (DMP).

USA.gov - "Handling a Deceased Person's Financial Problems": A direct portal to government information on managing financial issues after a death, including Social Security benefits, taxes, and debts.

Credit & Debt Management Tools

AnnualCreditReport.com: The only official, government-mandated website for free credit reports. You can get your reports from Equifax, Experian, and TransUnion here.

Rob Berger's Mint Alternatives: A comprehensive and regularly updated review of the best budgeting apps available, perfect for finding a tool that fits your personal style.

Vertex42: An outstanding resource for a wide variety of professionally designed financial spreadsheets and calculators for Excel, OpenOffice, and Google Sheets, including many free budget and debt-reduction worksheets.

Calculators & Worksheets

NerdWallet Debt Payoff Calculator: A simple but powerful tool that helps you compare the Debt Snowball vs. Debt Avalanche methods using your actual debt numbers.

Bankrate Loan Calculators: A suite of calculators to help you understand mortgage payments, auto loans, and personal loan costs.

Key Research & Reports

For those who wish to dive deeper, these papers provide valuable context on the financial challenges discussed in the hub.

"The Financial Consequences of Widowhood" (Social Security Administration): A research paper exploring the significant income drop and financial challenges faced by women after the death of a spouse.

"Medical Debt Burden in the United States" (KFF): A detailed report on the prevalence and impact of medical debt on American households.

"Issue Brief: The No Surprises Act" (American Academy of Actuaries): An explanation of the key consumer protections provided by the No Surprises Act regarding medical billing.

Financial News & Education

These websites provide high-quality, accessible articles on all aspects of personal finance.

NerdWallet: Known for its easy-to-understand articles, product reviews, and financial calculators.

Kiplinger: A long-standing and respected source for personal finance news, retirement planning, and investing advice.

The Balance: A comprehensive site that breaks down complex financial topics into clear, actionable advice.

Investopedia: An excellent resource for defining financial terms and understanding investing concepts.